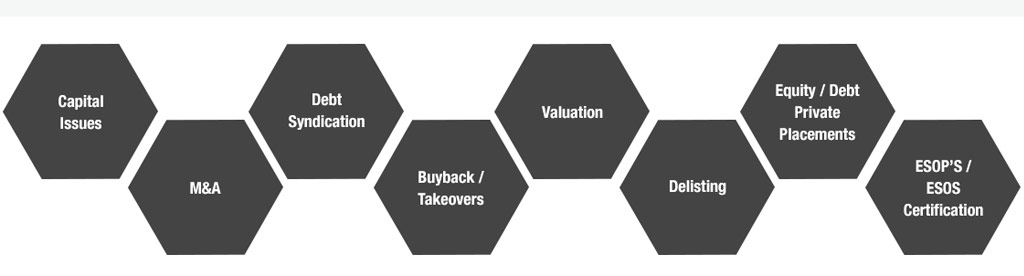

We undertake management of public issues under the Book Building method and Fixed Price method. Our offerings include IPO, FPO, Rights Issue, Preferential Issues, (QIPs) and Debt placements. We focus on organizations’ growth and success in the long term by constantly advising them on various strategies for growth.

We focus on providing solutions and support in implementing strategic decisions of our clients on target evaluation, acquisition, strategic alliances, divestitures, restructuring, de-mergers, privatization and mitigation of potential takeover threats. We are active on both buy-side and sellside mandates leveraging our industry knowledge, deep relationships and extensive experience in facilitating and financing acquisitions. The scope of work typically involves short-listing of targets, reviewing the valuation methodology, providing fairness opinions, supporting negotiations, structuring the transactions, complying with SEBI Takeover Code after fully factoring the regulatory, tax and legal issues involved.

We assist private and public companies in strengthening their balance sheets by delivering capital structure alternatives designed to provide a solid foundation for continued growth and the creation of long-term shareholder value. KISL acts as a placement intermediary to assist clients with both secured and unsecured debt syndications in various forms like-

We have strong relationships with various Banks, NBFCs, and Financial Institutions

We advise our clients on the need for a buyback and the mode to be adopted given the prevailing market conditions. We help the companies to optimally price the buyback and carry out all the due diligence and regulatory activities involved.

We provide advisory services on the following:

We provide valuation services with respect to the following:

We assist companies to voluntarily get the shares delisted from the Stock Exchanges by providing advisory services from start to finish. Our scope includes advising the company on procedural aspects and other compliance matters.

We assist companies in their equity fund raising activities and provides end-to-end advisory solutions to companies in high-growth markets on their capitalization/re-capitalization strategies. We leverage our network of relationships with various funds managers, Private Equity & Venture Capital Firms while raising equity funding for Corporates. Our team is well equipped to understand and formulate business plans of companies, structure their fund raising programs, equity dilution etc and help them raise funds from the public markets as well as from the private markets by placing all forms of equity like –

We assist the corporate in implementing ESOP Schemes in compliance with SEBI ((Share Based Employee Benefits) Regulations, 2014. Our scope involves assisting the corporate in setting various parameters like; number of options to be granted, vesting schedule, exercise price, etc. advising on drafting of various resolutions required to be passed and drafting of the scheme and obtaining in-principle approval from the Stock Exchanges.

Address: (Registered Office)

Plot no. 31, 8th floor, Karvy Millennium,

Nanakaramguda, Financial District,

Gachibowli, Hyderabad 500032

Tel:

+91 40 23428774 / 23312454

33216840 to 33216844

Fax: +91 40 23374714

Email: cmg@karvy.com

Investor Grievances Email Id: igmbd@karvy.com

Website: www.karvyinvestmentbanking.com